LIC Jeevan Kiran Plan 870 - Life Insurance Corporation of India (LIC) has launched a new term plan named Jeevan Kiran Table Number- 870. This is a term insurance plan best suited for working individuals who have dependent children and parents. This plan provides family protection against death due to uncertainties of the policy holder at a very low premium.

"LIC’s Jeevan Kiran 870 is a non-linked, non-participating, individual, pure term insurance plan,” Under LIC Jeevan Kiran Plan 870, the policy holder receives back all the premium paid in case he/she survives the end of policy term, LIC of India has launched this scheme on 27th, July 2023.

Please Note: You can now buy online LIC Jeevan Kiran plan 870 through credit card/debit card, net banking, upi and wallets on our LIC's New Business Platform.

Flexibility to choose from two benefit options: Single Premium and Regular Premium

(1) Non-Smoker rates and

(2) Smoker rates

| Particulars | Minimum | Maximum |

|---|---|---|

| Age at Entry | 18 years (Last Birthday) | 65 years (Last Birthday) |

| Maturity Age | 28 years (Last Birthday) | 80 years (Last Birthday) |

| Policy Term | 10 years | 40 years |

| Basic Sum Assured | Rs. 15 Lakhs | No Limit |

| Premium Payment Options |

Regular Premium : Same as policy

term Single Premium : Single Payment |

|

| Minimum Premium |

Regular Premium - Rs. 3,000/- Single Premium - Rs. 30,000/- |

|

| Premium payment mode | Single/yearly only/half yearly |

Also read this » LIC life time plan with maturity

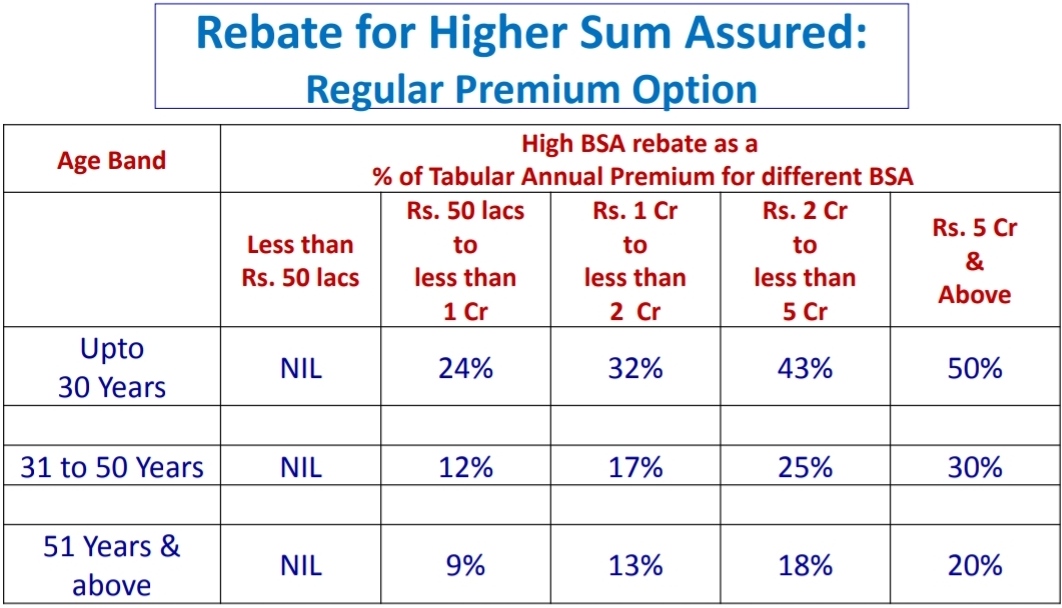

The following rebates/loadings shall be applicable:

(1) High Sum Assured Rebate

The High Sum Assured rebates are as under:

(a) Under Regular Premium payment:

The rebate for high Basic Sum Assured (BSA) as a % of Tabular Annual Premium is as under:

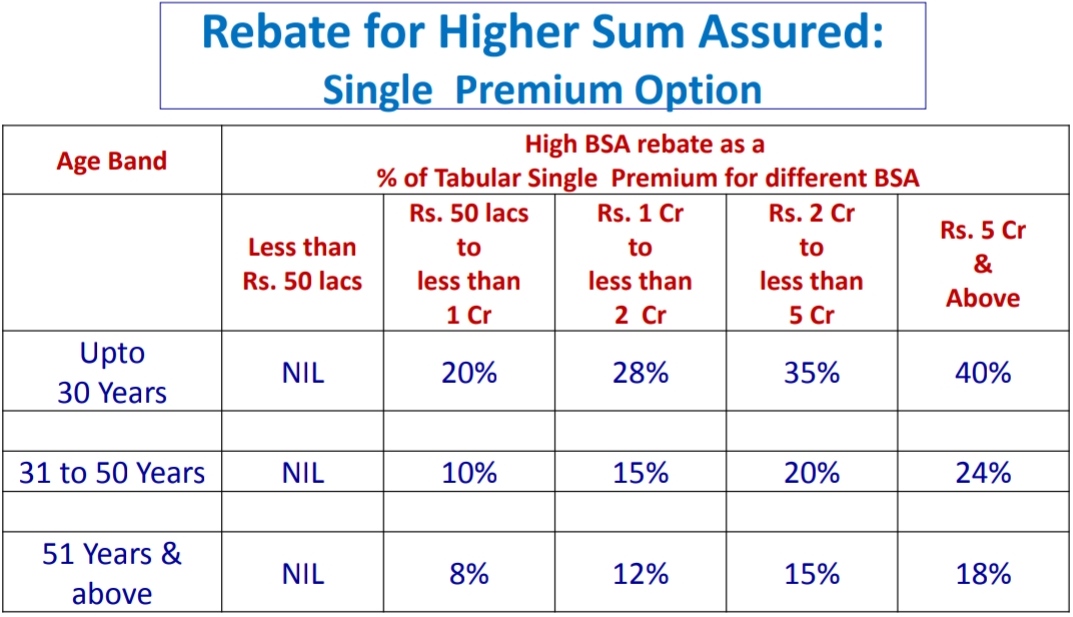

(b) Under Single Premium Payment:

The rebate for high Basic Sum Assured as a % of Tabular Single

Premium is as under:

(2) Mode Loading (applicable for Regular Premium payment):

| Mode | Loading as a % of Tabular annual premium |

|---|---|

| Yearly | Nil |

| Half-Yearly | 2% |

Benefits payable under an in-force policy shall be as under:

Death benefit payable on death of the Life Assured during the

policy

term after the date of commencement of risk but before the date

of

maturity

provided the policy is in force and claim is admissible shall be

“Sum Assured on Death”.

For Regular premium payment policy, “Sum Assured on Death” is

defined as the highest of:

For Single premium policy, “Sum Assured on Death” is defined as the higher of:

On Maturity- survival of the life assured to the end of the policy term, maturity sum assured equal to Total Regular/ single premium OR 105% Total premium paid.

Let's understand how LIC Jeevan kiran policy 870 with return of premium works:

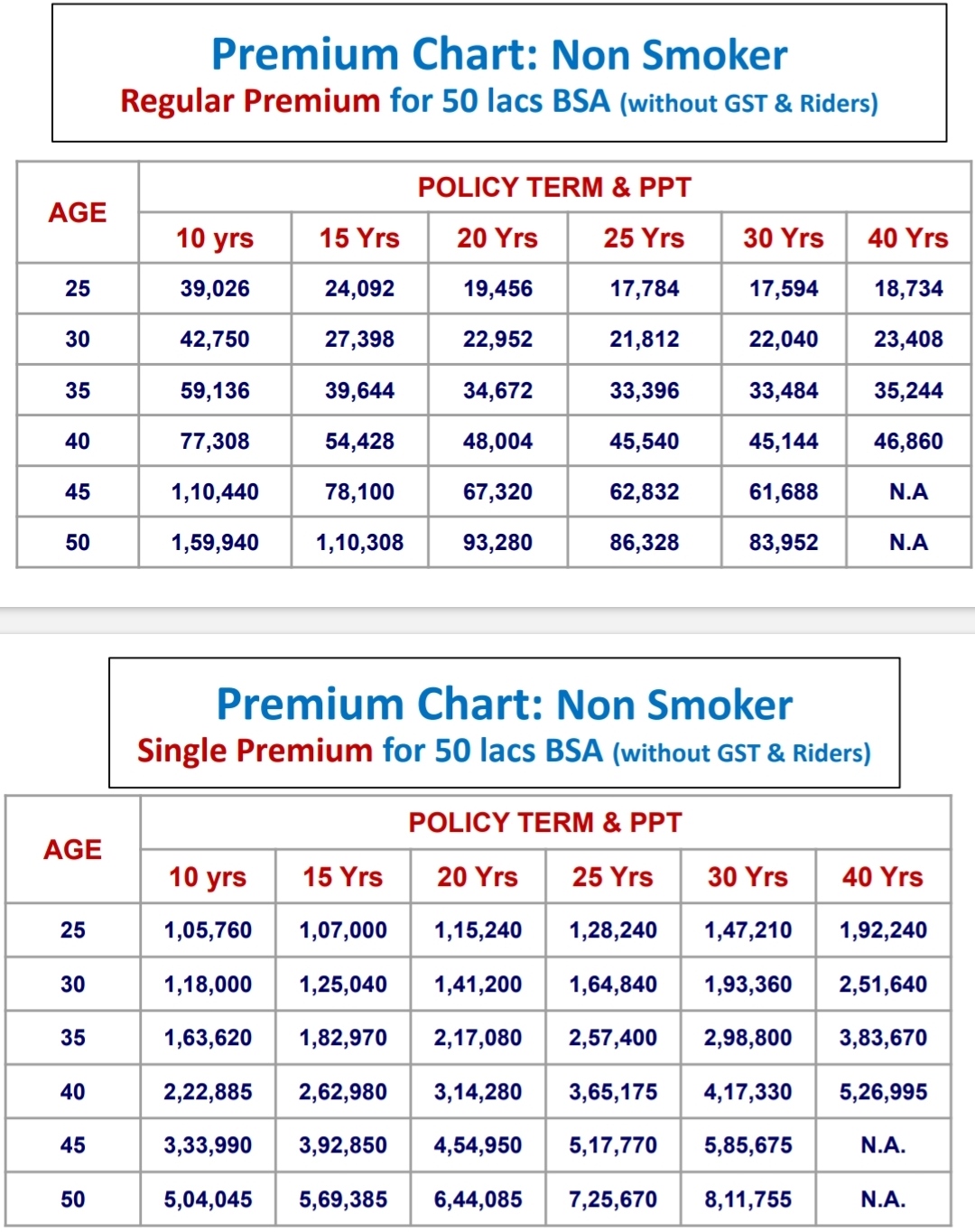

Mr. Mohan is a 30 years old man buy this plan to secure their family, Mohan is healthy, and active without any history of medical problems or smoking habits. He buys LIC's term insurance plan 870 with return of premium and chooses a sum assured amount of Rs. 50 Lakhs.

The yearly premium that is payable for the plan is Rs. 22952 for a tenure of 20 years. If Mr. Mohan died within the policy term, the individual within the policy term, the beneficiary/nominee will receive the sum assured amount of Rs. 50 Lakhs. But if Mr, Ram survives the policy tenure, he will be eligible for a maturity payout under the 'LIC term insurance plan 870' with return of premium. He will get (Rs. 22952 X 20) i.e., 4,59,052 upon maturity of the plan.

Also read this » LIC best money back plan

LIC Jeevan Kiran Plan 870 Premium Chart for Non Smoker

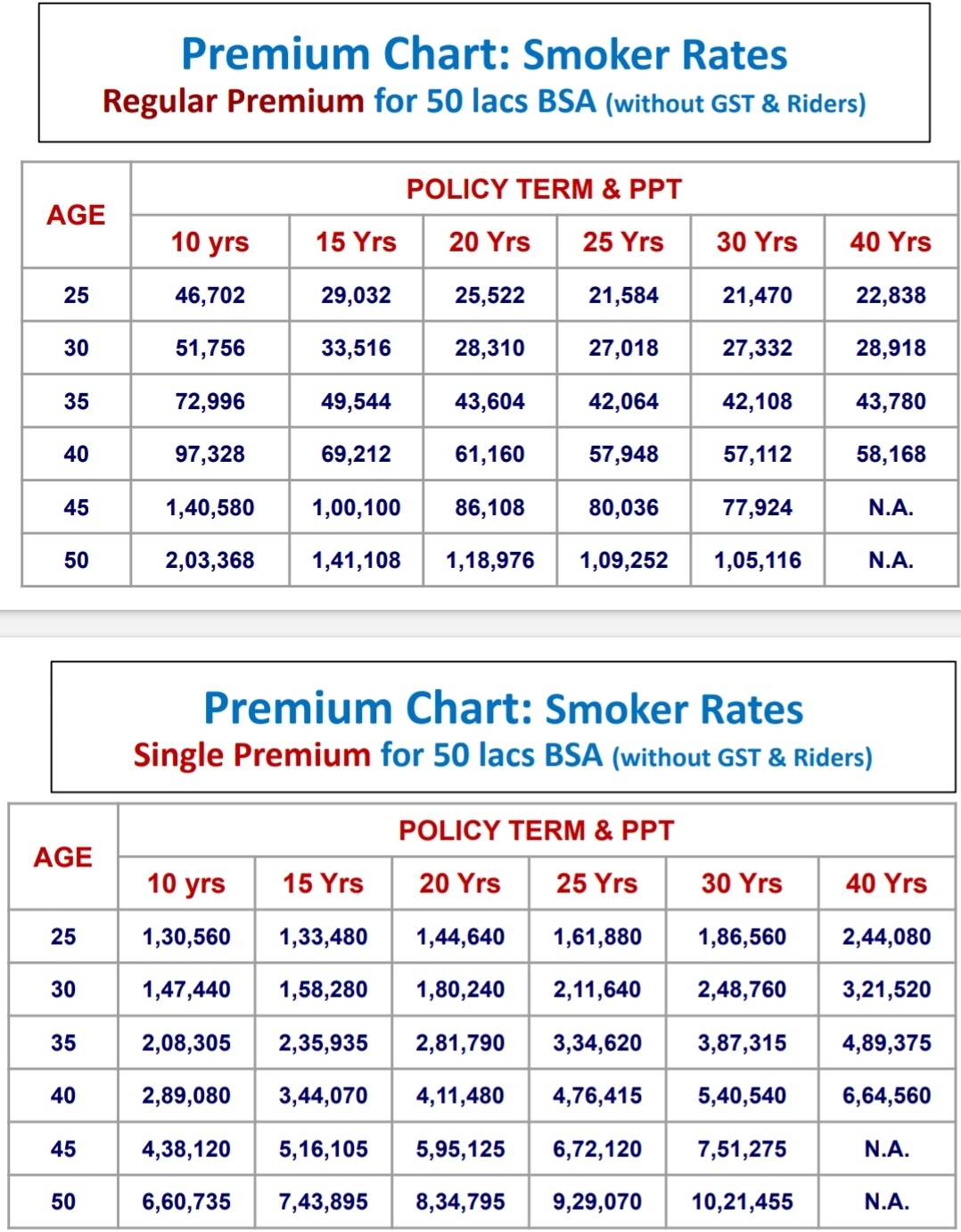

LIC Jeevan Kiran Plan 870 Premium Chart for Smoker

Tax Benefits - This plan will have benefits

under Section 80C and Section

10 (10D).

Policy revival- within 5 years of FUP.

Free look Period - if the policyholder is not

convinced with the terms and conditions of the policy, she/he can

cancel the policy within 15 days from the receipt

of the policy document.

GRACE PERIOD (APPLICABLE FOR REGULAR PREMIUM PAYMENT): A grace period of 30 days will be allowed for payment of yearly or half-yearly premiums from the date of First Unpaid Premium during this period.

The policy shall be considered inforce with the risk cover without any interruption as per the terms of the policy, If the premium is not paid before the expiry of the days of grace, the Policy lapses

SURRENDER: Under Regular Premium during the policy term provided two full years’ premiums have been paid. Under Single Premium payment, the policy can be surrendered by the policyholder at any time during the policy term.

The Surrender Value payable shall be higher of Guaranteed Surrender value (GSV) and Special Surrender Value (SSV).

POLICY LOAN: No Loan will be available under this plan.

Luptatem accusantium doloremque laudantium totam rem aperiam, eaque ipsa quae ab illo inventtatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt.

Luptatem accusantium doloremque laudantium totam rem aperiam, eaque ipsa quae ab illo inventtatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt.

Luptatem accusantium doloremque laudantium totam rem aperiam, eaque ipsa quae ab illo inventtatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt.

Cicero are also reproduced in theirm accompanied by English versions from the translation.